The Most Important Things You Need to Know About Correcting Your Credit

Many credit related questions can be answered by looking reading through this material.

Credit Report Errors – First and Last Points You Need to Know:

If you learn these four things you have 80% of credit reporting law down cold:

- Narrow Dispute: Make your dispute as objective as possible versus he said / she said.

- Direct Dispute: Directly dispute all errors with the credit reporting agencies; you may send the dispute to the creditor reporting bogus information in addition, but credit law demands you send the dispute to the credit reporting bureau before you have rights with a credit reporting error.

- Big Three: Concentrate on the big three credit reporting agencies – everything else is probably tri-merging. Equifax, Trans Union and Experian.

- Documents are Key: Keep everything straight – keep a log, make copies of everything you send, confirm phone calls in writing, note enclosures on all letters. Don’t dispute your credit over the phone using 800 numbers provided by the credit reporting bureaus and don’t use electronic disputes through the credit reporting website.

Things about credit reporting you probably didn’t know:

- Dispute With the Credit Bureau: Usually you should be talking with the credit-reporting bureau, not the creditor to get your rights under the Fair Credit Reporting Act when there’s a dispute over a credit account.

- Bankruptcy: Generally, the pattern of paying before the bankruptcy is filed can be reported but if that debt is discharged, it should be zeroed.

- A Creditor Charging Off a Debt: Does not necessarily cancel the debt or eliminate the reporting of the late payments.

- Divorce and affect on debt: Contract is usually the most important document for the creditor, not the order dividing your debts.

- Consumer is not the customer: Credit reporting bureaus get their money from selling as many credit reports to creditors as they can. Not from the consumer.

- “Sure Thing” letters aren’t a sure thing: Sending generic letters you found on a credit repair website citing statutes and codes without crafting them to your situation is no substitute for a letter with your specific circumstances. Plain language works best.

SECTIONS

- Most Important Laws Affecting Credit Reporting

- Most Important Credit Reporting Problems

- Backbone of Credit Reporting Industry

- 5 Steps you need to know about Correcting Your Credit

- 5 More Steps you need to know for Theft of Identity

- Credit Scoring and Other Weird Things

MOST IMPORTANT LAWS AFFECTING CREDIT REPORTING

There are five laws that affect credit reporting in Washington State. Four of these laws are federal, and the Washington Legislature passed one.

- The most influential is the Federal Fair Credit Reporting Act 15 U.S.C. sections 1681 – 1681u (“FCRA”). The FCRA became effective in 1971 and underwent a major revision with the Consumer Credit Reporting Reform Act of 1996, then the Fair and Accurate Credit Transaction Act went into effect in December 2004.

- The Washington Fair Credit Reporting Act RCW 19.16.182.010 et seq. (“Washington FCRA”) was based on the old Federal FCRA, but has not been updated since the recent changes in the Federal FCRA.

- Washington Collection Agency Act. RCW 19.16. Regulates collection agencies in Washington with most of the regulations and prohibited acts in RCW19.16.250.

- Consumer Protection Act RCW 19.86 prohibits unfair or deceptive acts in trade or commerce. Many state consumer protection statutes are preempted where a claim is based on credit reporting.

- The Equal Credit Opportunity Act 15 U.S.C. sections 1691-1691f, in addition to prohibiting discrimination in granting credit, requires that credit grantors provide certain notices to people when taking adverse action on an application for credit.

- The Federal Credit Repair Organizations Act 15 U.S.C. sections 1679-1679j provide strict limitations on organizations that repair credit for profit.

- The Fair Debt Collection Practices Act, 15 U.S.C. sections 1692-1692o, regulates debt collectors and specifically creates liability for them providing false information to third parties (including credit reporting agencies) if they know or reasonably should know that the information is false.

- Defamation, Negligence, Invasion of Privacy. Many state common law remedies are conditionally preempted meaning you can’t bring some of these claims unless you can show recklessness.

- Real Estate Settlement Procedures Act 12 USC Section 2605 late payment credit reporting during transfer of a home loan. Qualified Written Request.

- Fair Credit Billing Act. 15 U.S.C. Section 1666; 12 C.F.R. 226. Applies to “open end” credit accounts (credit cards, and revolving charge accounts). It does not cover installment. contracts – loans or extensions of credit repaid on a fixed schedule.

MOST IMPORTANT TYPES OF CREDIT REPORT ISSUES

- Unauthorized Inquiries

- Inclusion of Information

- Background Checks

- “Credit Repair”

- Inaccurate Reports

- Theft of Identity

- Credit Scoring

Credit Reporting is an extremely complex topic but I will be dealing mostly with fixing inaccurate credit reports and to a smaller degree with theft of identity (but mostly as it relates to inaccurate reporting) and to an even lesser degree with credit scoring.

BACKBONE OF THE CREDIT REPORTING INDUSTRY GENERAL

Main Reporting Agencies: There are three main, national credit reporting agencies (CRAs): Experian Information Solutions, Inc. (formerly known as “TRW, Inc.”), Equifax Information Services LLC and Trans Union LLC. The “Big Three”.

Local Bureaus: In addition to the Big Three there are many companies that combine Experian, Equifax and Trans Union reports into one credit report or might use one and incorporate it into something like a rental report. If all three are combined into one report, this is called a “trimerge”. Trimerges are usually used in mortgage lending. Since the trimergers parrot the Big Three, you should concentrate your efforts on Experian, Equifax and Trans Union and the others should fall into place.

Credit Bureaus You Didn’t Know About:

- Check Screening – Certegy Check Services (Website: AskCertegy.com); ChexSystems (Website: ConsumerDebit.com); TeleCheck (Website: FirstData.com/telecheck).

- Business credit: Dunn Bradstreet – reports on the creditworthiness of businesses.

- Medical history: Medical Information Bureau – compiles and stores your confidential and private medical information for use by insurance (Website: MIB.com).

- Rental reports: Various companies. Typically combine civil and criminal case information with a single CRA’s credit report. Contemporary Information Corp. (Website: CICreports.com); CoreLogic SafeRent (Website: residentscreening.com); First Advantage Resident History Report (Website: FADV.com); Leasing Desk (Real Page) (Website:RealPage.com); Tenant Data Services (Website: TenantData.com).

- Employment History Reports. Accurate Background (Website:AccurateBackground.com); EmployeeScreen (Website: IQ EmployeeScreen.com); HireRight (Website: Hireright.com); First Advantage (Website: FADV.com); Verifications (Website: Verifications Inc. ) and many others.

How Bureaus Get Information: The Big Three collect information from court records, banks, credit card companies, finance companies, department stores, cellular phone companies, court records, and many other companies issuing credit. Sometimes, one of the Big Three will not have all your credit information since not all creditors report to all three agencies (however, most major credit card companies and banks do) and not allpublic records information is acquired by all three bureaus. One CRA may have incomplete information, for instance reflecting a tax lien but not the amount or the fact that it was released. Another might not even report the first lien.

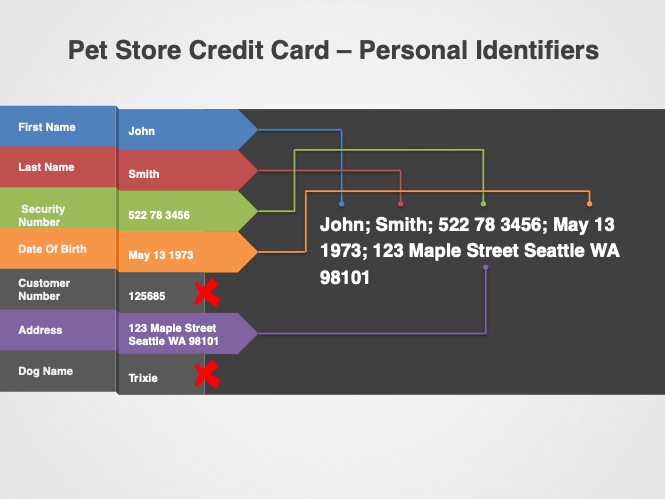

Pictured above: Example of Personal Identifiers that might be maintained in a pet store credit card’s internal database.

If a pet store had its own credit card and was maintaining data on the consumer it would need to maintain information on the consumer and on the account. A lot of times the data it maintains would not be in the format used by the credit reporting bureaus and would include more information than the credit reporting bureaus wants to get.

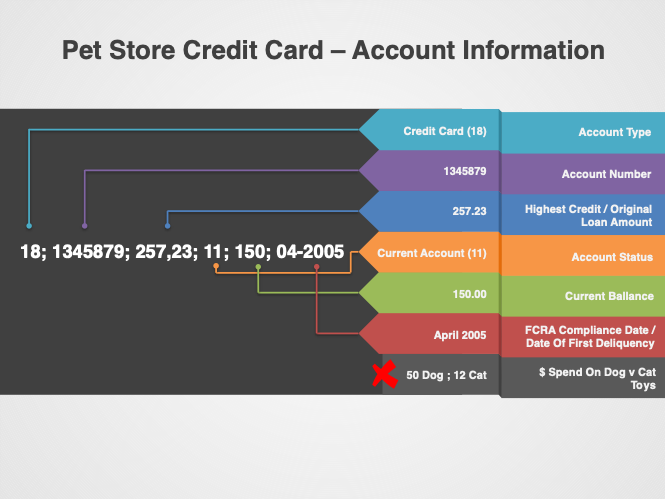

Pictured above: Information on an individual account of a consumer in the internal database. The information on the account itself is also maintained by the pet store on its internal database and the Xs above show information that the credit reporting bureau doesn’t want to get and well have to be filtered out, with the remaining data provided in a series of strings of data.

Credit Report Is Changing: A credit report is not a paper file kept in one place at a credit reporting bureau. This is part of the reason correcting credit errors can be so frustrating. The credit reporting bureaus have all your information saved in a particular format in a big, interconnected data-base. Your information is maintained with everyone else’s. When a credit reporting bureau receives information from creditors and others, it all goes into one big “vat” of information or a few different vats owned by affiliated companies.

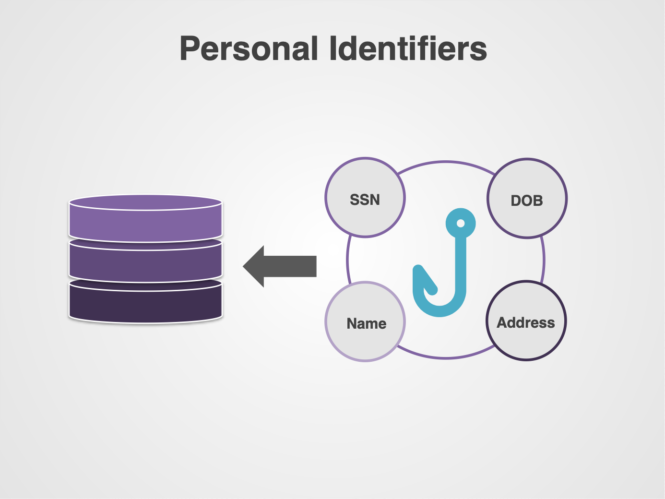

When a business inquires into or “pulls” your credit report, a search program or algorithm pulls information from this vat based on your “personal identifiers” such as your name, address, date of birth and social security number. It is kind of like an internet search engine algorithm, except of course the credit reporting algorithm should be very selective in what it includes. The search algorithm is supposed to filter out obsolete credit information and credit information that doesn’t belong to you. The remaining information is combined into one report. Your credit report isn’t something fixed since the information used to create your credit report is constantly changing as creditors pour information into the “vat”.

These characteristics of the credit reporting database system when combined with the credit reporting bureau’s bias to including information, can result in errors that puts other people’s information on your report and vice versa. The hook used to pull credit data to put into reports is the personal identifiers – Name, SSN, date of birth and address.

5 STEPS YOU NEED TO KNOW ABOUT CORRECTING YOUR CREDIT

FIRST STEP: GET A CREDIT REPORT

Get A Copy Of Your Report: Consumers may obtain a free copy of their consumer report on line once every 12 months. Simply go to www.annualcreditreport.com and request your complimentary Equifax, Experian and Trans Union profiles and they provide an address as well at Annual Credit Report Request Service PO Box 105281 Atlanta GA 30348-5281 and phone number 887-322-8228. Note: please be careful if you type in the web address as crooks reserved similar site names hoping to intercept private information. Also note: despite the risk of mistyping, the company running the annual credit report site has disabled some links to it, so if that happens here, please carefully type the address in your browser.

Otherwise, the costs vary depending on your state. On line it costs about $9.50 if you haven’t been denied credit in the past 60 days based on information provided in your consumer report. You can pay with check, money order or with a credit card.

The addresses can be found here.

Credit Bureau Reports: Paid reports.

http://www.experian.com/consumer-products/credit-check.html

http://www.equifax.com/credit-report-history/

http://annualcreditreport.transunion.com/tu/disclosure/order.jsp?package=TransUnionPaidDisclosureXML

No Fee if Denied Credit: You are entitled to a free report within 60 days of credit denial. The agency on which denial is based will be mentioned in the notice.

SECOND STEP: READING THE REPORT

When you get your credit report the credit reporting agency may include a pamphlet or similar paperwork explaining how to read their particular format. There are generally five sections as follows:

Identification Information: This section usually includes your name, address, social security number, date of birth, former addresses, your employer’s name, your job description and possibly your home phone number.

Credit History: This section shows various accounts and how timely you paid on them. The Consumer Financial Protection Bureau states about 40% is credit card information, 18% retail credit cards, 13% debt collection accounts, seven percent student loans, seven percent closed end consumer loans (i.e. car loans), seven percent mortgage loans and five percent other loans. Fair Credit Reporting, section 3.2.3.2.3, p. 80, National Consumer Law Center, 8th Ed, 2013.

- Tradeline. There are two main types of accounts you see under “credit history.” The first is revolving credit – meaning the minimum amount owed may be definite, but the payment due each month can be variable. This is typical of credit cards. Second is “installment accounts” – a definite amount due in fixed installments. A mortgage payment is typical of these, also student loans. Underneath the accounts, it may reflect how and when payments were made on them. The credit bureaus break-down the account if there are late payments to show how many payments are 30, 60, 90 and 120 days past due (and some indicate later past dues of 150 days). Thus (3)(30), (2)(60), (1)(90) means you have paid three times past 30 days, two times past 60 days and once 90 days past the due date. If an account is fairly old, it may state that it is a “charge off”, if you paid it after it was charged off it may state that it is a “paid charge off.”

- Collection Accounts. These accounts are being collected, usually by a collection agency, but sometimes also by companies that buy huge portfolios of charged off debt collect as well as some alleged law firms. Some collection agencies like to operate under the name of a lawyer or law firm to scare consumers by making litigation appear more likely.

Public Records: It used to be a wide variety of pubic records information was reported on consumer reports by the national bureaus including criminal cases, small claims and lawsuits. Now it is almost all Federal Tax Liens, State Tax Liens (aka Tax Warrants), Bankruptcies and Judgments. Most if not all the national credit reporting bureaus get their information from LexisNexis Risk Data Retrieval Service LLC. All the information they provide is derogatory, meaning it will not improve your creditworthiness if it ends up on your credit report. They get bankruptcy information from federal government websites and some state websites, but they also go to the courthouse or may buy the information from the courts. There can be some problems, especially with family members with the same name (e.g. junior senior relationships or the same or similar names).

Inquiry Section: This is a listing of businesses that have either pulled your full credit report, pulled certain information on your report or have “prescreening” your report. The credit card company you applied to, the car dealership that illegally pulled your credit report, the credit bureau pulling your report at your request and others will show as inquiries. Generally if your full credit report was procured, an abbreviated name of the business will appear without initials in front of it. Generally, if a company with which you already have an account pulls your credit report or if a company’s name appears that you have no affiliation with, there is a chance that your name and address were provided to the company as part of a “prescreening” program. “Prescreening” means that a creditor has gone to the credit bureau and asked for a list of addresses of people who meet certain criteria (e.g. mortgage over $300,000 etc.).

THIRD STEP: LOCATING THE CAUSE OF CREDIT MISTAKES

Errors In Credit Reports Occur Often: fraud, data entry mistakes, improper merging of information by the CRA to name a few. The errors can be caused by the creditor, the CRA, a thief, or a collection agency, public record etc.

- Creditor error. Improper Format: The creditor or “furnisher” of information to the CRA provides the information in a database format that allows the CRA to bring the information right into its database without entering everything again. The individual pieces of data are known as “fields”. The current format is “METRO 2”. METRO 2 was created in order to comply with the 1996 amendments to the Fair Credit Reporting Act. However, some very large creditors, including some large national credit card companies have not moved to METRO 2 and are still using METRO 1. This can create many problems in providing correct consumer information, especially regarding bankruptcy.

- CRA Error. Most credit reporting agencies use name, address, social security number and date of birth to identify who you are. The CRA can err mismerging information where identifying information is similar. This happens most frequently where there is a junior/senior relationship. It also can happen when social security digits are similar within two digits. If the adult child with the same name as the parent moves home, big problems can result. There can also be problems where a recently married spouse has the same first name as a step child or the ex-spouse.

- Collection Agency Error. Some companies intentionally (and illegally) place collection accounts on credit reports to get the victim to pay. Collection agencies know some people will pay amounts, even if they don’t owe, if they are attempting to get credit. Under recent amendments to the FCRA, you can proceed against the collection agency that improperly reports the information. The source of the problem sometimes arises because creditors and credit bureaus sometimes don’t provide enough identification details when inputting new information into a file.

- Incorrect Names: An incorrect name or social security number inputting by the creditor can go to the wrong consumer’s file (e.g. incomplete consumer’s name such as “J.M. Jones” could either be “John Michael Jones” or “Jay Milhous Jones” or any other combination, “Sam” could be “Samuel”, “Samson”, or a female “Samantha.”) This frequently happens with common names or where there is a junior/senior relationship.

- Theft of Identity. Please look to the section on Theft of Identity below.

- Public Records Error. The Big Three pay companies to go through court files and official records to obtain information. Judgments, bankruptcies and tax liens are the most frequently reported public records. If the reporting agency does not have the company check often enough, the fact that a judgment or bankruptcy was later vacated or satisfied may not get reported. Tax liens are a frequent cause of errors in credit reports.

Basic Concepts: Charge Off: Federal regulations provide that a delinquent account is to be charged off 180 days after the date of delinquency. 64 Fed. Reg. No. 27, 6655 “Uniform

Retail Classification and Account Management Policy”

FOURTH STEP: WHY DOCUMENTS?

Documents Are Important. Many credit card companies, banks and even credit reporting agencies provide toll free numbers and websites you can use to dispute credit errors. It’s better to document your credit error dispute on paper. However, if you decide to use the phone, follow-up in writing. Acknowledge the conversation (e.g. “this letter is a follow-up to my conversation by phone with your representative named Joe Smith in which we discussed . . .”). Send everything in writing by certified mail, return receipt requested. There are many reasons to write the dispute in addition to or instead of over the phone. Some of these are as follows:

- Show Concern. Just the fact that you bothered to collect your thoughts and write formally shows you truly are concerned with the credit errors on your report. If you need the help of an attorney or regulatory agency later, they are more likely to take note of the seriousness with which you regard the matter.

- Objective versus Subjective proof: Your goal should be to turn a dispute involving subjective proof (i.e. you have to talk to a bunch of people to get to the bottom of things) into a matter where a third person could come in and look at your letters and tell the credit reporting was mixed up.

- Allow you to accurately track case. There may be many people involved in your dispute before it is resolved. First, many of the employees of credit institutions turn over regularly and you may be sent to a different person for each investigation. Also, you may need to show your paperwork to attorneys, law enforcement (in fraud cases), regulatory agencies and perhaps to a court. Having documents helps others “get up to speed”. Many credit companies use software to have a chronology of their contacts with you, but it is recorded in a very self-serving manner to make the company look reasonable at your expense. Don’t rely on a creditor keeping track of your matter in anything but a self serving manner.

- Legal Effect. The obligations of some credit companies under some laws are not triggered unless you provide a written dispute.

FIFTH STEP: SEND DISPUTE LETTERS

Send Disputes to Credit Reporting Bureaus. It is imperative you send dispute letters directly to the credit reporting agency. This is not only a logical step, to have an action against a company that provides false data to a credit reporting bureau, you must provide the credit reporting bureaus notice and the liability of that furnisher under the Fair Credit Reporting Act depends on their response to the credit dispute it provides to the credit reporting bureau. One of the difficulties in sending disputes to the credit reporting bureaus is they want to accept disputes online. Experian has been especially difficult in shutting down a post office box where it accepted disputes for years (PO Box 9595 at Allen Texas). It didn’t forward it’s mail to another address. Do your own research on addresses before mailing your letters. The addresses that have worked recently are as follows:

- Experian. O. Box 4500, Allen, TX 75013You can check at www.myfaircredit.com to see if Experian lists a physical address. It is obvious it wants everything sent electronically or by phone. The Experian Parkway address is not the official Experian address, but it will be hard for them to stop deliveries on their doorstep!

- Equifax. Equifax Information Services LLC O. Box 740256 Atlanta, GA 30374-0256. This is an address that has worked recently. Double check the address before sending correspondence at www.myfaircredit.com

- Trans Union. TransUnion Consumer Solutions, P.O. Box 2000, Chester, PA 19016-2000 is an address that has worked in the past. Check as best you can before you send a dispute. www.myfaircredit.com.

Send Credit Disputes By Certified Mail Return Receipt Requested. Many attorneys who deal with credit reporting issues think it’s imperative you send the disputes by certified mail return receipt requested instead of by phone and over the internet. With certified mail, you can track the letter all the way to the credit reporting bureau: www.usps.com. You’ll need the Receipt for Certified Mail (attach this form to the letter following the directions at the bottom of the receipt), the Domestic Return Receipt (fill in sections Addressee 1; Article Number 2; Service Type 3, check “certified mail”; also write your address on the reverse site) and, of course, postage. At the time this was written the cost is $4.42 to send a letter with a couple pages by certified mail return receipt requested ($4.79 if you send more than a couple pages and on from there) . Check at www.usps.com for postal rates. Although the post office seems to want the letter presented to them for the receipt to be stamped, simply putting the correct postage on the letter and placing it in the mail, then tracking it on the web seems to work. Talk to your local post office to determine how it likes to handle the mailing.

Some tips I have for sending letters based on a few years of experience:

- Attachments: Double check all the attachments are included in each letter.

- Out of Envelope: If sent by US Mail, by certified mail return receipt requested is best and usually better to go into the post office with them ready to go but not sealed in the envelope so you can write the “receipt for certified mail” number on each letter and your copies (or you can use the little sticker that detaches from the bottom of the receipt for certified mail);

- Not Registered Mail: Registered mail is not necessary. Just Certified and Return Receipt Requested;

- Copies, Notes and Receipts: Have copies of all the letters made including each attachment with the written receipt for certified mail number on it (or the little sticker with the number on it). Don’t plan on using the Word file as evidence. Nothing beats a copy of the letter with a handwritten note on it stating when the originals were posted or picked up by FEDEX with the receipt for certified mail stapled to it. Handwritten notes are really helpful on these things used as evidence.

- Costs: Keep a copy of the receipt for mailing.

Where to Send Credit Disputes. It is not absolutely necessary to send disputes to the company furnishing incorrect credit information to the credit reporting agency, but it certainly doesn’t hurt and may put them on the same sheet of music with the credit reporting agency with the investigation, especially in theft of identity cases where there are affidavits and police reports. Believe it or not, the credit reporting agencies do not send your dispute documents to the furnisher of information – they typically just summarize the dispute into a code. If a credit reporting bureau were reporting the Gettysburg Address, the story would read: “Code 8 – Died For Union”. Your affidavit, police report or copies of other relevant documents will not be sent on. The bureaus are not truly concerned with the “maximum possible accuracy” as required by the FCRA. Like your disputes with the credit reporting bureaus, you will want to send it all by certified mail return receipt requested. Some credit card companies have been known to deny receiving mail even when their representative signed a receipt for certified mail! You can only imagine which garbage can a dispute not received by certified mail goes into.

Styles of Credit Disputes. Goal: to make the dispute objective versus strictly “he said/ she said”. With disputes you want to provide the information necessary to have your dispute investigated and convey what is happening to you as a result of the false credit reporting. There are no statutes you need to state in the letter as long as you provide in plain words what you are demanding. Letters that have a lot of statutes sometimes look a little too smart for their own good. If a company has a statutory obligation under the Fair Credit Reporting Act, Fair Debt Collection Practices Act or the Fair Credit Billing Act, giving them the statute isn’t going to affect that obligation as the demand is stated in plain English.

Basics of Contesting Credit Errors. The minimum information is as follows: 1) Name of the company reporting the inaccurate entry; 2) credit account number; 3) a statement that the account was in error; 4) why you believe the credit report is in error; 5) what you want done (i.e. whether you want the entire account deleted or corrected in a certain way); 6) that you want a statement from the CRA of the manner in which it investigated the claim including the name and phone number of anyone contacted in connection with the reinvestigation; 7) your name, social security number, address and date of birth; 8) attach relevant documents to your dispute. Further, you may want to attach a copy of your credit report from that company or a copy of your drivers license or utility bill that shows your current address if you moved recently. You might also add requests for verification if you are dealing with a collection agency, statement of billing error if you are dealing with a credit card company and demand to send corrected information directly to a company that pulled your report if you were denied credit based on an error in a report. See below for more details and examples at the end of this book.

Types of Credit Disputes. Credit dispute letters should be tailored to the type of recipient and the sender’s situation. The credit disputes below are just an example and should be a starting point in deciding what to write. There are some companies that sell credit dispute forms. No credit dispute form can possibly be used to solve the many types of errors consumers encounter. Rather than use credit dispute forms, a consumer is better off being providing the information that covers their individual situation. Letters to credit reporting bureaus and furnishers of information should consider the Fair Credit Reporting Act, disputes to collection agencies should take into account the Fair Credit Reporting Act, the Fair Debt Collection Practices Act and possibly the Fair Credit Billing Act and disputes to credit card companies may want to take into account the Fair Credit Billing Act.

Multiple Disputes, Increasing Information Provided. If you send more than one dispute, you should send more information each time you dispute, perhaps providing more detail each time, attaching documents or even providing a declaration if the matter becomes a matter of he said/she said. You should not send the exact same dispute over and over but respond to any claim made or implied. Keep in mind the shifting responsibility – the more information you provide the more the furnisher and reporting agency is supposed to do in the investigation.

Noting Debt As Disputed. An important right you have to improve your credit score is noting a debt as disputed during the credit report dispute process. You have this right under many laws and it has been interpreted as applying to furnishers of credit report information under their obligations to investigate and modify information on a credit report.

- Under the Fair Credit Reporting Act the furnisher has a duty to report the dispute. 15 USC section 1681s-2(a)(3) Duty to provide notice of dispute. If the completeness or accuracy of any information furnished by any person to any consumer reporting agency is disputed to such person by a consumer, the person may not furnish the information to any consumer reporting agency without notice that such information is disputed by the consumer.

- For Washington consumers and business people, you have rights to note debts as disputed under the Washington Collection Agency Act 19.16.250(10)(a): licensee (ie collection agency) shall, upon receipt of written notice from the debtor that any part of the claim is disputed, notify the credit reporting bureau of the dispute by written or electronic means and create a record of the fact of the notification and when the notification was provided.

- Fair Debt Collection Practices Act 15 USC 1692e(8) Communicating or threatening to communicate to any person credit information which is known or which should be known to be false, including the failure to communicate that a disputed debt is disputed.

If you dispute the debt, you should send the dispute to the company furnishing your information when you are lodging a credit report error dispute. Otherwise, companies that review your reports may assume you agree with what is reported.

Summary.

- Send in paper letter. Disputes over the phone or internet tend not to be worth the paper they aren’t written on. If the customer representative is abusive, the recordings tend to “disappear” and account notes written by a customer service representative tend to be very self-serving (for the one taking the notes, not you!).

- Dispute With Spouse. If you and your spouse jointly dispute your credit reports, you can send in one letter with both names and identifiers listed.

- Assume you’ll have to send more than one letter and having the date on all the letters helps you and more importantly a person helping you (government agency, attorney etc) keep it all straight.

- Proper address.

- Credit Bureau. Put in the proper address for the credit reporting bureau provided above. Sometimes the bureaus change their addresses (especially the PO boxes) so double check the addresses provided here before sending. It may be better to send to street address for credit reporting bureau and that opens up the possibility of sending by FEDEX and UPS (these private companies cannot deliver to a PO Box).

- Furnisher of Bad Information. Some of the addresses of furnishers in the credit report are bad because creditors have not updated what they provided the credit bureau. If you are lodging a “billing dispute” for a credit card, be sure to send to the address provided in your agreement or on the billing. Dig up your old agreement or if you can’t find it you may be able to find it online with new applications.

- Your address. Hopefully you can use an address that the credit bureaus have had on file for a few months to correspond. If not consider sending a utility bill and license with your new address to reduce problems.

- Identify Yourself.

- For Credit Reporting Bureaus, list your name(s) social security number and date of birth.

- For creditors or collection agencies, list account numbers and collection account numbers.

- Identify The Information Disputed. If it’s an account you are disputing, the account numbers (old credit card account number and collection account); public records, by the cause number and court or other number assigned by the credit reporting bureau (“I dispute the listing on my report of a tax lien filed in King County in Downtown Seattle Cause number 14-1496-OSEA; and if identifying information provide what is reported and what should be reported (“a social security number 532 55 5555 is on my report and mine is 532 55 5556.

- Technical Stuff:

- Collection Agency. Consider whether to say you “dispute the debt” (if true) and/or “refuse to pay” (this may bring the matter to a head and they may sue you). Credit card company: state they have made a “billing error” or you have a “billing dispute.” Look at your agreement to find the correct address to send the written dispute to. Consumer Must:

- Write to the creditor at the address for “billing inquiries,” only,

- Letter must be received within 60 days after the first bill containing the error.

- The letter should be sent by certified mail, return receipt requested,

- Credit Bureau. State whether you are asking them to “correct” or “delete” the listing.

- Proof of Identity. Increasingly bureaus are claiming they don’t have confidence you are who you say you are even if your address has been the same for 10 or more years. To avoid them sending your letter back with a demand for a copy of your license or utility bill, it is a good practice to send a copy of the driver’s license (showing your current address) and a utility bill or two.

- Theft of Identity. Considerations:

- Sending in a police report or affidavit of fraud as an enclosure.

- Ask for an initial fraud alert to get notice when someone applies for an account using your credit (good for 90 days); to get an extended fraud alert (good for seven years) send in an affidavit of fraud.

- Plain Statement. Don’t use statutes you found on the internet. Most disputes can be summarized in a few paragraphs. Ask specifically that the reporting be corrected or deleted.

- Summary. When you have a bunch of errors on your credit report it can be difficult to address all one by one without making the dispute letter as big as an encyclopedia. Instead, some things can be summarized succinctly by stating saying something like “I have paid all my bills on time and I dispute any account listing a late payment” (if true) or “I never opened an account in 2015 and that is when a thief applied for credit in my name, delete any account that claims to have been opened after 2014 as I never applied for credit after 2014 and that is when the thief apparently was active.”

- Enclosures. Consider sending copies of documents that prove the error. Public record records, letters and for theft of identity, police reports and affidavits of fraud (the FTC has a standardized version). Refer to the enclosure below your signature.

- Sign your letter.

- Make a copy of your letter. There are some apps that you can make a PDF copy of your letter, or more low tech, you can fax it to yourself or take a picture of it.

5 MORE STEPS YOU NEED TO KNOW FOR THEFT OF IDENTITY

If your identity has been stolen, you will quickly find that theft of identity can be a challenge to overcome without an attorney. I recommend you contact an attorney knowledgeable in theft of identity and credit laws to help you through this difficult time. Some general information is provided below. This is provided for informational purposes and may or may not apply to your situation.

If you think your private information has been compromised, you should do four things right away.

FIRST STEP – GET YOUR CREDIT REPORTS. See how to order your reports under Correcting Your Credit above. It is important for you to review the “tradeline” section and the “inquiry” section of your reports. The tradeline section shows the payment histories of established accounts, i.e. accounts where credit has been granted (e.g. credit card companies, car loans etc.). It can take weeks or even several months for opened accounts to appear in the tradeline of a credit report. The time lag happens because credit card companies and loan companies only report monthly.

The credit inquiry section of a credit report is the most important section to find out what is happening to your credit. This shows what companies have pulled your credit report. The credit inquiry section will show on your credit report as a credit inquiry almost immediately. From the credit inquiry section, you can get a good idea of any accounts that may appear on the tradeline in the next few weeks (after the lag period mentioned above). You can see if there are any patterns to the inquiries. If you don’t have recent inquiries you might rest a little easier, although theft of identity is still possible ( for instance for checking accounts, someone assuming your identity to apply for a job etc.). If you see many applications, but the accounts never appear in the tradeline, there is a possibility the thief was turned down for credit in your name.

Chronologically, the next credit report section that is involved in the theft of identity timeline is the collection accounts (these accounts are separate on Equifax reports and blended with tradelines on Experian and Trans Union reports). Generally, credit companies charge off delinquent accounts after six months and when they do, they send it to collection agencies (although they can and are assigned much earlier). The result of bad checks from a fraud related bank account may start appearing on the credit report (under the collection account section) a few months after the fraud (since most states require notices to be issued to the last known address of the consumer) and have been known to pop up years later. There is some possibility a judgment may be taken against the defrauder using your name. A judgment will usually appear on the credit report over six months later.

In sum, by looking at the credit report you can tell the likelihood you are a victim and, if so, the scope and timeframe of the fraud (and whether the defrauder is still applying for credit). Inquiries will show immediately, tradelines will show a few weeks later, collection accounts a few months later, checking accounts a few months or years later and judgments months or years later.

SECOND STEP – ORDER A FRAUD ALERT. If you think you are a theft of identity victim, this may actually be your first step. The fraud alert discloses a phone number you provide and asks any creditor opening a credit account to call that number before opening a credit account. Using this technique can be a problem if you move or change your number. Supposedly, contacting one credit reporting bureau will list the alert on all reports (however, out of caution, you should contact each). There are two types of fraud alerts. An Initial Alert stays on your report for 90 days. An Extended Alert stays on your report for seven years. To have an Extended Alert implemented, you will have to provide an affidavit of fraud (below).

THIRD STEP – GET A POLICE REPORT. This can be difficult with some police departments. If all you can get is a case opened without a report, be sure to get the report number and the name of the police officer taking your report. This way you can refer anyone conducting an investigation into the reporting of your credit over to the proper person. If the police department refuses to accept a report, be sure to memorialize this in writing (e.g. “this letter is to confirm you will not take my report of crime of theft of identity against me . . .”). Some extremely abusive credit card companies insist on the police report where the credit card company extended credit to a family member who does not want to do this to a family member. If this situation applies to you, it is important that you contact an attorney to give advice on what to do.

FOURTH STEP – COMPLETE AFFIDAVIT OF FRAUD. The Federal Trade Commission helped put together an affidavit of fraud that all the credit reporting bureaus accept. The FTC affidavit is available at www.MyFairCredit.com.

FIFTH STEP – DISPUTE. Dispute the Accounts in Writing. See Correcting Your Credit. It’s important to send your disputes to the credit reporting bureaus in addition to the duped creditors. Check the section Correcting Your Credit above.

Additional Steps That May Apply.

- Opt Out of Prescreening. As part of the same procedure, you may want to consider opting out of credit offers. Credit reporting bureaus sell some of your information to companies that then mail you offers. If you use a rural mailbox or the place you receive mail is not secure, this is a problem. You can eliminate these mailings even if you aren’t a victim of fraud. The number to opt out is 888 567 8688 (888-5Opt-Out).

- Credit Freeze. Some states allow you to put a freeze on your credit that allows you to turn on and off the ability to apply for credit. This is not an item covered under the Fair Credit Reporting Act so you will have to check your own state’s laws regarding this.

- Checking Account Theft of Identity. The most hard-to-resolve issues for victims of theft of identity happen when the thief is able to obtain a checking account in the identity of the victim. Hundreds of checks can be issues that in turn may involve many collection agencies. In addition, there are companies that guarantee checks that appear in almost every case of checking account fraud. These companies are merging and being sold, so you may have to check if the number has been disconnected. These companies are as follows:

TeleCheck: (800) 366-2425, www.telecheck.com.

Other Places You Can Find Help.

- Department of Motor Vehicles. Someone may have obtained a drivers license using your identity. Check with your state licensing agency.

- S. Postal Service. If mail theft or a bogus change of address card was submitted, the U.S. Postal Inspector should be contacted. http://www.usps.com/postalinspectors/fraud/welcome.htm

- Social Security Administration. If your social security number has been used by an identity thief, contact the SSA Fraud Hotline (800) 269-0271, PO Box 17768 Baltimore, MD 21235; email: [email protected].

- Federal Trade Commission. ID Theft Hotline: 1-877-IDTheft(438-4338); ID Theft Clearinghouse, FTC, 600 Pennsylvania Ave NW, Washington DC 20580.

- State Attorney’s General. Especially good at providing you information on your state. The National Association of Attorneys General has contact information on all state’s Attorneys General. Check at myfaircredit.com for a list of attorneys general.

- Consumer Financial Protection Bureau. Regulates and enforces consumer financial products. Lots of focus on military.

Preventing Theft of Identity. (From King County Prosecutor’s Office – Fraud Division “Protect Yourself From Identity Theft”)

- Car prowl is a prime source for identity theft. Thieves know to look in merchandise bags for credit receipts – which often print your credit card number.

- Have your mail delivered to a secure location. Mail box theft is another common source for identity thieves. Your credit card bill has everything a criminal needs to make purchases by telephone or on the Internet.

- Don’t put bill payments in your unlocked mailbox for postal pickup.

- Carefully review your account statements and credit bills. Contest any unauthorized items or entries.

- Don’t give out personal information over the telephone unless you initiated the call. Identity thieves can pose as representatives of banks, ISPs, collection agencies, government agencies, etc. to get you to reveal your account numbers, passwords, SSN, or mother’s maiden name.

- Never use a debit card or check when shopping online. Once stolen from your account, it can be difficult to recover your money. Consider using one credit card only for your online purchases. Use a secure browser when sending credit card numbers over the Internet. Review your bill carefully as soon as you get it. Contest unauthorized charges.

- Keep a list of all your credit/debit cards, card numbers, and issuer phone numbers. This will facilitate your reports to creditors/banks if your purse/wallet is stolen.

- Memorize your ATM password. Never store the password in your purse or wallet.

- Shred your financial garbage. Including credit receipts, pre-approved credit offers, credit checks. Cross-cut shredders are best.

- Cancel unused credit cards and charge accounts.

- Be stingy with your SSN. Don’t give it out to everyone who asks. Make thoughtful decisions regarding whether the requester really needs it. Ask to use other types of personal identifiers.

- Do not print your SSN or drivers license number on your checks. Take only the number of checks you will need on a given day. Keep pads of blank checks in a safe place.

- Never carry anything with your SSN on it. If your health insurance card shows your S SN, ask your insurer for a new card without the SSN. Until you get your new insurance card, carry it only when you need to use it.

- Prevent credit reporting agencies from selling your name, SSN, address and credit rating. Merchants who want to offer you credit cards or sell you merchandise buy your financial information. This is a source for personal information that can ultimately be published on the Internet. Contact the “Opt out” option of all credit reporting agencies.

- Prevent your creditors and identity clearinghouses from selling or “sharing” your personal information.

- Your creditors generally sell or “share” your name, address, SSN, financial information, spending and bill paying habits unless you tell them not to. This information often finds its way to clearinghouses for personal information, and to the Internet. Find sample letters preventing disclosure at Privacy Rights Clearinghouse, privacyrights.org and JUNKBUSTERS, www.junkbusters.com. Clearinghouses and other publishers of personal information are listed below.

- Obtain and review your credit reports regularly. Check all three major credit reporting agencies. Dispute incorrect information. Be sure the agency has a correct address for you, especially if you have moved or suspect your identity has been stolen. Contact information for credit reporting agencies is below.

CREDIT SCORING

The impact of credit scoring is major and getting bigger every day. Credit scores are basically consumer reports reduced to numbers using a very complex equation devised by different companies. Statisticians have gone through data of people who defaulted on their loans and determined what happened before default. The results are factored into an algorithm that creates a credit score number using your credit report and assign you a number based on what is allegedly your likelihood of default.

In 1989 Fair Issac Corporation and Equifax jointly developed the most widely used credit scoring system, called the “FICO score”. The scoring system ranges from 300 to 850. Generally speaking, the best deals go to those with a score of around 770 and higher. The median score is 725 and a score below the mid-600s will likely put someone in the “sub-prime” market. The interest rates demanded in the sub-prime market are higher. Frontline: The Secret History of the Credit Card (2004). You can find your credit score at www.myfico.com (for a fee).

According to Fair Issac Corporation, the credit score is determined by weighing the following factors – payment history – 35%; length of credit history – 15%; new credit – 10%; types of credit used – 10%; amounts owed – 30%.

Experian uses the FICO score. Trans Union used the “Empirica Score” and Equifax uses a “Beacon Score.” The Empira and Beacon scores were also created by Fair Issac Company. A certain score for home loans is now required by Freddie Mac and Fannie Mae if the loan is to be sold into the secondary market. The scores are also used for credit cards. Since the algorithms that create the score are considered proprietary, you may only get a vague sense of why you were denied credit. The growth of credit scoring limits the effectiveness of other methods of disputing credit reports such as statements of dispute. The statements will not be factored into the equation.

Problems with Credit Scoring:

- Inaccuracy of information going to CRA’s – Information being provided by furnishers to CRAs can be inaccurate. I’ve seen many furnishers not know very basic information about the format used to report to the CRAs and many knowingly report inaccurate information such as the date of first delinquency because of the prevalence of credit scoring and importance for a consumer to resolve issues with their credit report before a loan will go through;

- Phony criteria – Such bogus evaluations as being over 50 percent of available balance, credit inquiries and other silly criteria, make consumers just arrange their affairs inconformity with the credit scoring methodology and not true creditworthiness;

- Predictive value – to the extent the credit scoring methodology is accurate, it is relying on low hanging fruit – i.e. a person with balances due on a multiple collection accounts could be easily predicted without relying on a phony scoring system. If a person misses a couple credit card payments because he leaves the country frequently or is inefficient in his bill paying, how does that predict his creditworthiness if he has a million dollars in the bank? The credit reporting agencies only have a fraction of the information necessary to judge your creditworthiness. They don’t have (thank goodness) information on your bank account balances, your salary, your equity in rental property etc. Credit granting decisions are best made by an underwriter who has all this information. An evaluation of creditworthiness can be made by any competent lender in a few seconds if they have all this information in front of them. Because people want to believe they can predict what will happen or what likely will happen with regard to a consumer seeks a loan, just as there is a market for astrologers and psychics, there will be a market for this information, but a credit score is less predictive of creditworthiness than commons sense and experience.