Skip to content

Reporting Errors in Credit Reports

Reporting Errors in Credit Reports – Locating the Cause of the Report Error

The following list details some of the most common errors in Credit Reports.

- Creditor error. Improper Format: The creditor or “furnisher” of information to the CRA provides the information in a database format that allows the CRA to bring the information right into its database without entering everything again. The individual pieces of data are known as “fields”. The current format is “METRO 2”. METRO 2 was created in order to comply with the 1996 amendments to the Fair Credit Reporting Act. However, some very large creditors, including some large national credit card companies have not moved to METRO 2 and are still using METRO 1. This can create many problems in providing correct consumer information, especially regarding bankruptcy.

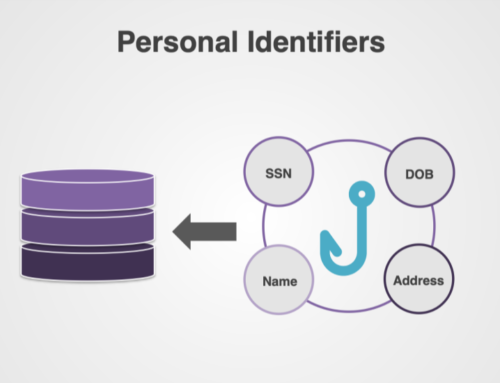

- CRA Error. Most credit reporting agencies use name, address, social security number and date of birth to identify who you are. The CRA can err mismerging information where identifying information is similar. This happens most frequently where there is a junior/senior relationship. It also can happen when social security digits are similar within two digits. If the adult child with the same name as the parent moves home, big problems can result. There can also be problems where a recently married spouse has the same first name as a step child or the ex-spouse.

- Collection Agency Error. Some companies intentionally (and illegally) place collection accounts on credit reports to get the victim to pay. Collection agencies know some people will pay amounts, even if they don’t owe, if they are attempting to get credit. Under recent amendments to the FCRA, you can proceed against the collection agency that improperly reports the information. The source of the problem sometimes arises because creditors and credit bureaus sometimes don’t provide enough identification details when inputting new information into a file.

- Incorrect Names: An incorrect name or social security number inputting by the creditor can go to the wrong consumer’s file (e.g. incomplete consumer’s name such as “J.M. Jones” could either be “John Michael Jones” or “Jay Milhous Jones” or any other combination, “Sam” could be “Samuel”, “Samson”, or a female “Samantha.”) This frequently happens with common names or where there is a junior/senior relationship.

- Theft of Identity. Please look to the section on Theft of Identity below for more information on errors in credit reports.

- Public Records Error. The Big Three pay companies to go through court files and official records to obtain information. Judgments, bankruptcies and tax liens are the most frequently reported public records. If the reporting agency does not have the company check often enough, the fact that a judgment or bankruptcy was later vacated or satisfied may not get reported. Tax liens are a frequent cause of errors in credit reports.

- Basic Concepts: Charge Off: Federal regulations provide that a delinquent account is to be charged off 180 days after the date of delinquency. 64 Fed. Reg. No. 27, 6655 “Uniform Retail Classification and Account Management Policy”

Domain Admin2020-08-17T20:59:22-07:00

Share This, Choose Your Platform!