How to Write a Credit Report Dispute Letter?

Use the following simple guidelines to write your credit dispute letter.

1. Send in paper letter. Disputes over the phone or internet tend not to be worth the paper they aren’t written on. If the customer representative is abusive, the recordings tend to “disappear” and account notes written by a customer service representative tend to be very self-serving.

2. Proper address.

a. Credit Bureau. Put in the proper address for the credit reporting bureau provided above. Sometimes the bureaus change their addresses (especially the PO boxes) so double check the addresses provided here before sending. It may be better to send to street address for credit reporting bureau and that opens up the possibility of sending by FEDEX and UPS (these private companies cannot deliver to a PO Box).

b. Furnisher of Bad Information. Some of the addresses of furnishers in the credit report are bad because creditors have not updated what they provided the credit bureau. If you are lodging a “billing dispute for a credit card, be sure to send to the address provided in your agreement or on the billing.

c. Your address. Hopefully you can use an address that the credit bureaus have had on file for a few months to correspond. If not consider sending a utility bill and license with your new address to reduce problems.

3. Numbers.

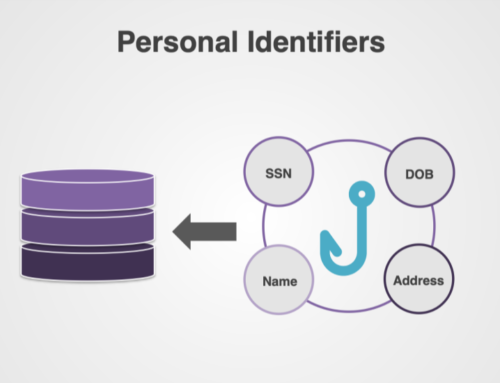

a. For Credit Reporting Bureaus, list your social security number and date of birth.

b. For creditors or collection agencies, list account numbers and collection account numbers.

4. Technical Stuff.

a. Collection Agency. Consider whether to say you “dispute the debt” (if true) and/or “refuse to pay” (this may bring the matter to a head and they may sue you).

b. Credit card company. state they have made a “billing error” or you have a “billing dispute.” Look at your agreement to find the correct address to send the written dispute to.

c. Credit Reporting Bureau. State whether you are asking them to “correct” or “delete” the listing.

d. Proof of Identity. Increasingly bureaus are claiming they don’t have confidence you are who you say you are even if your address has been the same for 10 or more years. To avoid this it is a good practice to send a copy of the driver’s license with your current address and a utility bill or two.

5. Plain Statement. Don’t cite statutes you found on the internet on how to write credit dispute letter. Most credit disputes can be summarized in a few paragraphs. Ask specifically that the reporting be corrected or deleted.

6. Summary. Some things can be summarized succinctly by stating saying something like “I have paid all my bills on time and I dispute any account listing a late payment” or “I never opened an account in 2015 and that is when a thief applied for credit in my name, delete any account that claims to have been opened after 2014.”

7. Sign your letter.

8. Make a copy of your letter.