Skip to content

Credit Reporting Error – 6 Facts You Didn’t Know

Credit Reporting Error – 6 Facts You Didn’t Know

Keep these six facts in mind if you have a credit reporting error.

- Dispute With the Credit Bureau: Usually you should be talking with the credit-reporting bureau in case of any credit reporting error, not the creditor to get your rights under the Fair Credit Reporting Act when there’s a dispute over a credit account.

- Bankruptcy: Generally, the pattern of paying before the bankruptcy is filed can be reported but if that debt is discharged, it should be zeroed.

- A Creditor Charging Off a Debt: A credit reporting error not necessarily cancel the debt or eliminate the reporting of the late payments.

- Divorce and affect on debt: Contract is usually the most important document for the creditor, not the order dividing your debts.

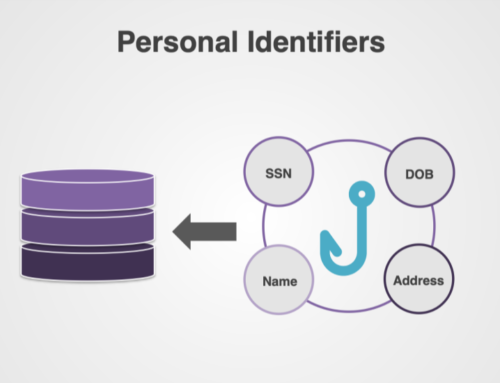

- Consumer is not the customer: Credit reporting bureaus get their money from selling as many credit reports to creditors as they can. Not from the consumer.

- “Sure Thing” letters aren’t a sure thing: Sending generic letters you found on a credit repair website citing statutes and codes without crafting them to your situation is no substitute for a letter with your specific circumstances. Plain language works best when reporting a credit reporting error.

Domain Admin2020-05-19T15:59:18-07:00

Share This, Choose Your Platform!